American Farm Bureau Federation President Zippy Duvall was clear in his message to President Donald Trump when the two met several weeks ago. Duvall told him that farmers like him do not support

“We don’t support your tariffs, but we sure hope that your efforts and your direction that you’re taking trade in is successful,” Duvall recalled saying while talking to crowds at Farmfest on Wednesday, Aug. 6.

Trump assured him that these deals would bring people to the table to level the playing field, according to Duvall.

He also had the opportunity to speak with United States Trade Representative Jamieson Greer, who told Duvall there would be no trade agreement without agriculture having a big stake in it.

But until those deals are made with key trade partners like Canada, Mexico and China, Duvall also knew it was clear that things are going to be difficult with the large incoming crop to deal with at a time when crop prices were slipping lower.

Michael Johnson / Agweek

“You go into the banker and talk about next year’s crop, and it’s going to be a difficult situation unless we have some bright, a bright outlook on the future when it comes to trade,” Duvall said.

on his second day on the job as Under Secretary for Trade and Foreign Agricultural Affairs, echoed what Duvall said, that agriculture must be in any trade deal. He saw the recent negotiations that have resulted in some trade deals as a glimpse into the “golden age of agriculture” from a trade perspective.

“Never before have we had more movement on the trade front to open up new markets and provide new opportunities for our farmers and ranchers than what President Trump has been able to do in his first seven months in office,” Lindberg said.

Lindberg mentioned a trade deal with Japan that is meant to bring $4.5 billion in new ag sales. According to the White House, Japan will purchase $8 billion in U.S. goods, including corn, soybeans, fertilizer, bioethanol, and sustainable aviation fuel.

While Lindberg shared his excitement about trade deals as a milestone, the delivery and payment for agricultural products was the finish line they need to reach.

Michael Johnson / Agweek

“The actual victory comes when we get sales done,” Lindberg said.

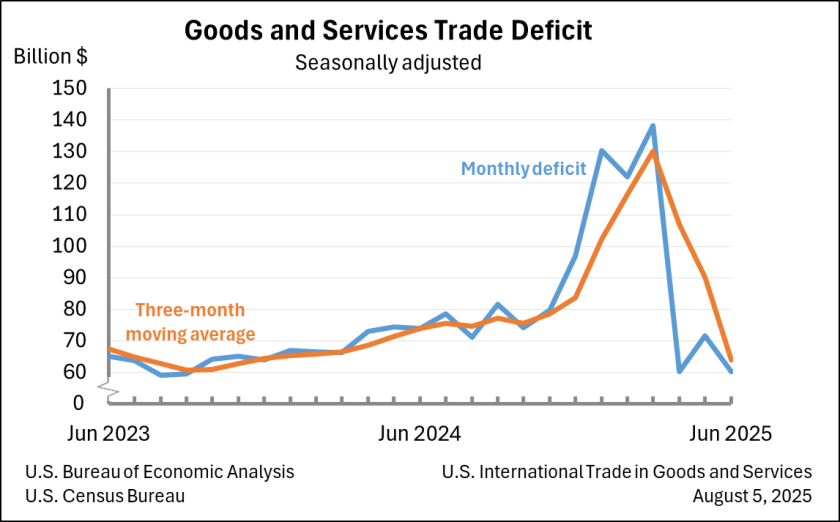

Lindberg said what concerns him is that the U.S. has a $50 billion trading deficit. The U.S. had a $60 billion trade deficit in June 2025, which is down from $71.7 billion in May 2025. So far, the big change is not in exports, but in fewer imports, according to data from the USDA.

Courtesy / U.S. Bureau of Economic Analysis and U.S. Census Bureau

Chad Willis, also on the trade panel with Duvall at Farmfest, is a Willmar, Minnesota, farmer, and past president of the U.S. Grains Council. He was asked by moderator Don Wick, of the Red River Farm Network, what the U.S. role is in building trade relationships. Willis explained that the U.S. must continue to fund overseas trade missions in order to hold up those relationships built over decades. He referenced funds that help the U.S. promote ethanol overseas.

“So that’s why I’m glad to see this extra money now for promotion in the, the Big Beautiful Bill, as they call it, ‘cause it’ll help organizations such as U.S. Grains and Soybeans, Meat Federation, to do more overseas. Trade is all about relationships,” Willis said.

Willis referenced a supplemental agricultural trade program

in the reconciliation bill that passed in July

. This makes available $285 million “to encourage the accessibility, development, maintenance, and expansion of commercial export markets for United States agricultural commodities” starting in 2027 and each fiscal year after.

The biggest issue that keeps coming up among ag groups is the $300 billion trade deficit with China, according to 2024 numbers. That’s a 5.7% increase over 2023, according to the Office of the U.S. Trade Representative. Randy Spronk, past chair of the U.S. Meat Export Federation, spoke about hurdles to overcome in this area, including a current 57% tariff on pork products imported into China. That was previously a 172% tariff.

“The rest of the world is about 12%,” Spronk said.

are a major determining factor as to whether China buys U.S. products, yet he adds that he believes the U.S. product remains the best value when it goes to China. He mentioned the “variety meats,” from pork and beef products, such as organs and other sub-prime edibles, are sought after in China, while less sought after in the U.S. Getting those products to China adds the highest value to each animal. But removing the tariffs will open the doors back to trading with China, according to Spronk.

China was the second largest importer of U.S. pork and pork variety meat last year, according to the U.S. Meat Export Federation; nearly 70% of that volume is variety meat.

Michael Johnson / Agweek

Darin Johnson, president of the Minnesota Soybean Growers Association, is hopeful for other soybean markets to open up, like India, but he’s not convinced that anything at the moment can replace the loss felt by China choosing South America for their soybean needs.

“In the end, it is, China is a tough, that’s a tough number to replace,” Johnson said.

That number is 115 million metric tons that China purchases in a year. They were buying 58% of the total U.S. exports of soybeans. The U.S. exports about 50% of its soybeans.

“That’s equivalent to all the other countries’ imports,” Johnson continued. “So it’s, it’s a really quite a staggering number when you think about it that way.”

Michael Johnson / Agweek

The next highest is the European Union, at 14 million metric tons, about 100 million tons less than China.

The importance of adding value to a lower-priced commodity was emphasized by Willis. He mentioned turning corn to ethanol as one of those areas and added that Canada is the No. 1 ethanol export market. Mexico could be a large opportunity, he said.

Feeding the grains to cattle that can be shipped to other countries was another way Spronk saw to add value.

“Gotta add value to that kernel, especially

at these prices that we’re experiencing right now,”

Spronk said.

In the absence of a trade deal with China, Johnson responded to an audience question that farmers are going to have a very difficult time continuing without government assistance.

“Cause right now we’re operating really probably anywhere, depending on your farm, probably a dollar to potentially $2 for soybeans under the cost of production,” he said.

Johnson gave credit to the farmers in the room as a group of people who are willing to give up their retirement or equity in order to stay on the farm and give the next generation a chance at survival.

“I mean it makes my hair stand up on my arms thinking about it,” Johnson said.

He was aware that there were some farmers in the building who had been continuing the farm for six to seven generations.

“We are going to need some assistance if these negotiations do take some time, which, understandably, we want to make sure that we get it right, too.”